pay past due excise tax chicopee massachusetts

- Online Payment Processing. The annual excise due on a vehicle registered after January 1 will be reduced therefore by one-twelfth of the full years excise for every month prior to the month in which the vehicle was registered.

Annual Report Town Of Granby Massachusetts For

They also have multiple locations you can pay including Worcester RMV Leominster RMV and other locations listed on their website.

. Sending a demand for payment of the excise Set locally up to 30. It is important to keep the Registry the City of Melrose and the post office informed of a current name and address so the excise bills can be delivered promptly. Pay your outstanding obligations online by clicking on the Green area on the home page.

If you do not have a copy of your bill please email me at taxcollectorchilmarkmagov. Pay Excise Tax in Chicopee MA. This information will lead you to The State Attorney Generals Website concerning the Tax.

If you do not fully pay a motor vehicle excise on or before its due date you also have to pay. 64I and the Departments sales tax regulation on. A vehicle is registered on March fifth.

If that vehicle had. 3 years after the date the excise was due or. Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year.

Go to our online system. What if I do not receive an excise tax bill. To pay for a bill that is on warrant with the Deputy Collectors Office please call 508 747-4344 to find out the amount due and to pay over the phone with a credit card.

Interest 12 per year from due date to payment date and. You pay an excise instead of a personal property tax. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660.

This information will lead you to The State. You need to pay the bill within 30 days of the date we issued the bill. Simplify compliance with automation software designed to work together seamlessly.

Tax Department Call DOR Contact Tax Department at 617 887-6367. Please note all online payments will have a 45 processing fee added to your total due. A 10 demand fee will be charged to each bill.

Excise tax bills are owed to the citytown where the vehicletrailer was garaged as of January 1. You must pay the excise within 30 days of receiving the bill. Demand bills will be issued for any excise bill not paid by the due date.

This will send your payment to the citys lockbox vendor for automated. The city or town where the vehicle is principally garaged levies the excise and the revenues become part of the general funds of the municipality. You have until three years after the excise is due OR one year after you pay the excise bill to file an abatement.

When are the payments due for Motor Vehicle Excise. You can find the abatement form on the reverse side of your excise tax bill. Click on Motor Vehicle Excise Tax if you want further information concerning Excise Tax.

Excise tax payments are due 30 days from the original date of the bill after which a demand bill will be sent out with interest and penalty. MassTaxConnect Log in to file and pay taxes. Excise Tax is assessed at the rate of 2500 per thousand dollars of taxable value.

You can pay your excise tax through our online payment system. 1 year after the excise was paid. If you dont have a.

Chicopee City Hall 17 Springfield Street Chicopee MA 01013 Phone. WE DO NOT ACCEPT CREDITDEBIT CARDS AT ANY OF OUR WALK-IN. We accept payments for the following items.

Motor vehicle abatement form. Check or credit card at. THIS FEE IS NON-REFUNDABLE.

See reviews photos directions phone numbers and more for Pay Excise Taxes locations in Chicopee MA. Tax Department Call DOR Contact Tax Department at 617 887-6367. You must make payment in cash money order or cashiers check to have the mark removed immediately.

Payments are due on Monday March 28 2022. 9 am4 pm Monday through Friday. To make a payment please visit the Collectors Online Bill Pay.

All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. The Collectors Office is open except holidays Monday thru Wednesday and Friday 830AM to 400PM and Thursday 830AM to 600PM. You will not be cleared out of the RMV for non renewal until all past due taxes are paid on all outstanding plates.

The excise is based on information furnished on the application for registration of the motor. Contact Us Your one-stop connection to DOR. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

They can be reached Monday Friday 900 AM 300 PM. City parking tickets may also be paid by cash. We send you a bill in the mail.

Motor vehicle excise tax bills are due and payable within thirty days from the date of issue. You can request a copy by calling the TreasurerCollectors Office at 781393-2550 or by e-mail at collectormedford-magov. Deputy Collector PKS Associates Inc.

The following example illustrates the calculation of the excise due on a vehicle registered after January 1. If your vehicle isnt registered youll have to pay personal property taxes on it. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

You can also download and print a blank abatement form online. Interest at a rate of 12 per annum will be charged from the due date to the date of payment. Since 1981 the Massachusetts Registry of Motor Vehicles RMV calculates the value of vehicles for the excise tax at a rate of 25 per 1000 based on the value of the vehicle according to a depreciation schedule.

Pay Past Due Excise Tax Bills. Payment of the motor vehicle excise is due within 30 days from the date the excise bill is issued.

Massachusetts Auto Fuel Prices Mass Gov

What Does Your Vehicle Excise Tax Get Used For

Cis U S Senators Congressional Delegation And Their Districts

Chicopee Residents See Late Fees After Allegedly Not Receiving Excise Tax Bills

424b3 1 A2181190z424b3 Htm Prospectus Common Stock Quicklinks Click Here To Rapidly Navigate Through This Document Filed Pursuant To Rule 424 B 3 Registration No 333 145875 Prospectus Danvers Bancorp Inc Proposed

Braintree Rmv Service Center Mass Gov

Excise Tax What It Is How It S Calculated

Southbridge Rmv Service Center Mass Gov

Lowell Rmv Service Center Mass Gov

Cis U S Senators Congressional Delegation And Their Districts

Chicopee Gives Preliminary Approvals To New 15 Million Cannabis Cultivation Business Masslive Com

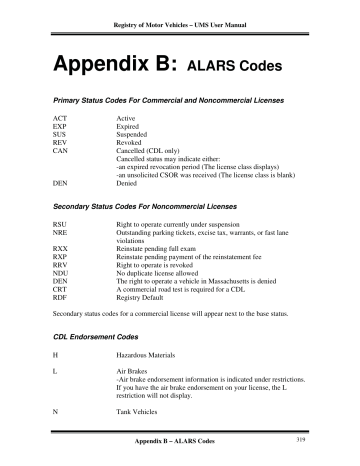

Appendix B Alars Codes Massachusetts Association Of Manualzz

Southbridge Rmv Service Center Mass Gov

Western Massachusetts Chiefs Of Police Association Holds 29th Annual Police Memorial Day Service City Of Springfield Ma